Compute eXpress Link (CXL) is a rapidly developing technology borne from the quest for more efficient, faster, and scalable computing architectures. As an open industry standard designed to provide high-speed, efficient interconnectivity between processors, memory, and peripherals, CXL stands out for its ability to significantly enhance data center and high-performance computing (HPC) environments – whether in AI, fintech, or where processing power and memory goodput are critical. If this is your first swing at CXL, Rick’s got you covered

So where is this going? #

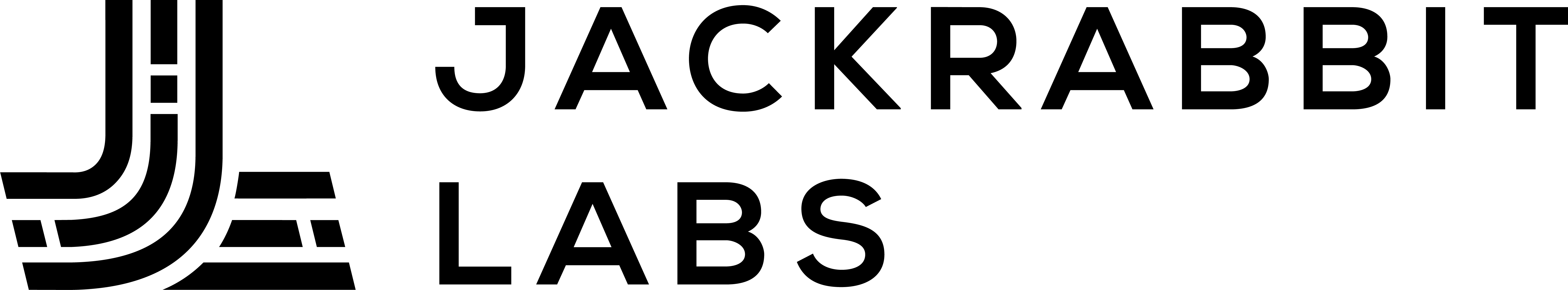

In 2023, The Yole Group produced “ Memory-processor Interface 2023: Focus on CXL”, taking a look at the players, technologies, and market trends driving the creation of new CXL hardware. Key players included Astera Labs, Montage, and Microchip, which are currently offering CXL expander controller chips. Additionally, CXL switches are here, fleshing out the components for enabling memory pooling and server disaggregation.

The report predicts that CXL deployments could transform the current server memory challenges into a significant market opportunity, projected to reach approximately $16 billion by 2028 - attributing that growth to the deployment of high-performance, cost-effective CXL memory expander controllers and CXL switches.

CXL technology is in its nascent stages but is expected to dramatically affect data center workloads, which are increasingly demanding more computational power and memory to manage growing data volumes. Memory costs, which accounted for about 30% of server value in 2022, are expected to exceed 40% by 2025. CXL addresses these challenges by optimizing resource use and speeding up data center workload execution, with broad industry support.

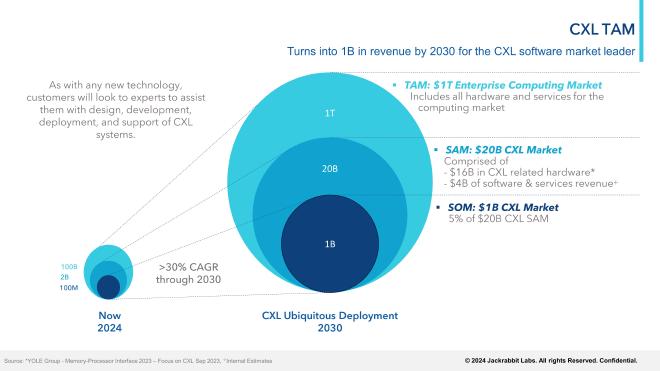

Based on that analysis, we’re anticipating the TAM for CXL (including software and services) from 2024 to 2030 is poised for more than slightly absurd growth. Our internal market analysis predicts a robust >30% CAGR for the CXL market, underpinned by its increasing adoption in data centers, cloud computing environments, and high-performance computing systems. And AI. LOOOOOOOOOTS of AI.

And we’re seeing it bare out with investment. South Korean venture capital is packing substantial investments in companies supporting CXL adoption. Many of the same companies mentioned in the Yole report are doubling down on CXL, developing flagship products backing the technology. And as that new hardware comes online, the benefits of adoption become more accessible to the broader market.

Now if only someone would write some software to bring it all together….